Best Free Budgeting App that will help you keep track of your spending and help you save better. In this article, we will explore the Top 5 great apps that you can find on the App Store and Play Store for better money management.

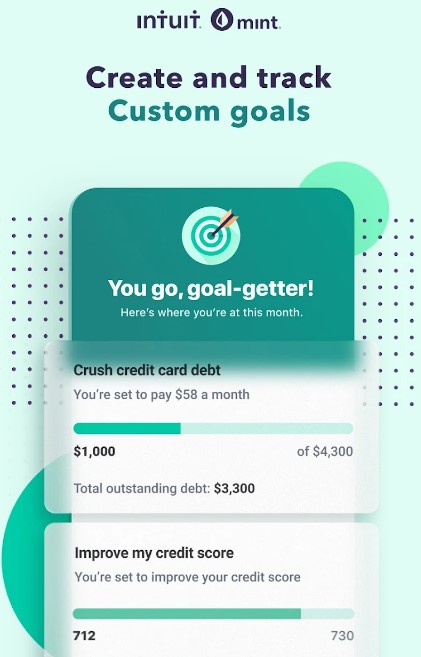

Mint App

The Mint App mention is probably the app that most people naturally gravitate to. It is free on both the Google Store and Apple Store. I want to say they also have a desktop version and that is the Mint app. The Mint app is one of those apps where you can connect all of your accounts, and it will track what you’re spending.

So let’s just say you go to the gas station, and you spend seventy-five dollars on gas. It will notify you and let you know that the fuel is seventy-five dollars. Are you sure this is where you want to categorize it?

More of a budget tracker

The Mint App it’s not a budgeting app, it’s more of a tracking app, so it does it after the fact. So after you spend your money, it tells you where you spent today. It does not do it beforehand. But what I will say is that if you are trying to define a budget or if you are constantly going over your budget, I would say to try the Mint app for several months. Because that can help you see where your money is going, it does a good job of categorizing.

It’s a smart way to start tracking your spending so that when you get a good idea, you can determine how much money should be in each budget category. As mentioned before, it is free to download, and it’s one of those easy simple-to-use apps on a scale of 1 to 10, with 10 being the hardest to navigate and one being the easiest. Just sync your accounts, and let the app do the magic for you.

Google Play Store: Mint App

App Store: Mint App

You Need a Budget, YNAB

You need a budget or YNAB for short. It is about fourteen points ninety-nine monthly or ninety-nine a year. YNAB is great for those people who are on a zero-based budgeting system. Zero-based budgeting is saying every single dollar that you have is going to be accounted for.

Example: let’s just say it’s Friday you get paid $1108.87 YNAB is going to account for every single dollar that you have coming in. I liked why now, because I felt like it was more. It’s more of complex so you can add your credit cards, bank accounts, or investment accounts.

YNAB Free Budgeting App

This money-management app is very useful for saving. You just start by setting a goal or project, such as saving ten thousand dollars this year. It helps you allocate your income towards your savings goals, which helps you stay on track. Once you’ve figured out your budget categories, like groceries and transportation, you’ll find it easy to manage your finances successfully.

Google Play Store: YNAB

App Store: YNAB

EveryDollar

So there are two different versions for EveryDollar. There is a free version and then there is a paid version, which is about $12.99 a month or $79 a year.

The free version, I wouldn’t suggest for many people. If you’re going to do the free version, you might as well just go to Mint, which allows you to sync accounts because the free version doesn’t allow you to sync any accounts. It’s just very manual. So if you put in “I have $700 in my Wells Fargo current account on Monday” and then you spend some transactions, when it comes time for Friday, you have to put all that in manually.

The paid version

I would recommend the paid version. So with the paid version, which, as I mentioned before, is $13 a month or $79 a year, you can link your bank accounts, you can link your savings accounts, and your investment accounts.

Just from me doing research on the App is that it looks like after you’ve done that for a month, or maybe even a couple of months, it can give you reports and recommendations based on your habits. So I saw one where it said, let’s just say you’re constantly going out, and you’re spending a ton of money at Publix going grocery shopping, but your budget says you’re only going to spend $100.

EveryDollar Free Budgeting App

After a couple of months, it can give you a report that says, “Are you sure you only want to put $100 in for your groceries? Because, based on your spending, you probably need to put $250.”

So it can kind of give you recommendations, kind of like a financial planner, but only $80 a year versus several hundred dollars a year for a financial planner. So it’s able to give you recommendations that say, “Hey, I don’t think you’re properly planning your budget accordingly because you’re constantly going over.”

Google Play Store: EveryDollar

App Store: EveryDollar

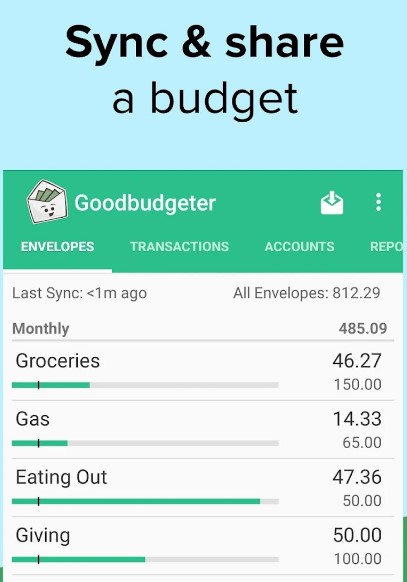

GoodBudget

The fourth Free Budgeting App that I’m going to mention is Good Budget. I didn’t even realize it was an app, and if I’m being honest, I think it could do some improvements. But I know a lot of people do this cash envelope system budgeting, so I assumed that I would mention that, and that is a Good Budget.

Exploring the Cash Envelope System and Free Budgeting App

So for those who are unfamiliar with the cash envelope system, it is a system where when you have your budget; you have all these different categories. Let’s just say you have it in Excel. The cash envelope system converts those categories, and puts them into physical envelopes, and those envelopes have the cash for the budget.

For example, your grocery budget is $100. On your app I have my zero-based budgeting app, I then have an envelope that I say that says groceries. And that envelope has the amount of money that I have budgeted for that. It’s a great way for those who want to make sure they stay on track with their spending if they have a tendency to get lost in the sauce or if they have a tendency to constantly go over budget.

Free Budgeting App versions Or Paid version?

Good Budget has two different versions; there is a free version and then there is a paid version. The paid version is about $8 a month, $70 a year. What I will say is both the free, and the paid versions don’t offer financial syncing, so everything that you’re doing has to be manual. You would go in at the beginning of every month, put in how much money you’re going to get paid, and how much money you’re going to budget under each category.

The difference between the free and the paid version is that the free version allows you to have two devices and unlimited envelopes. The paid version allows unlimited envelopes and accounts for up to five devices. So I am mentioning this app because I know some people do the cash envelope system.

Google Play Store: GoodBudget

App Store: GoodBudget

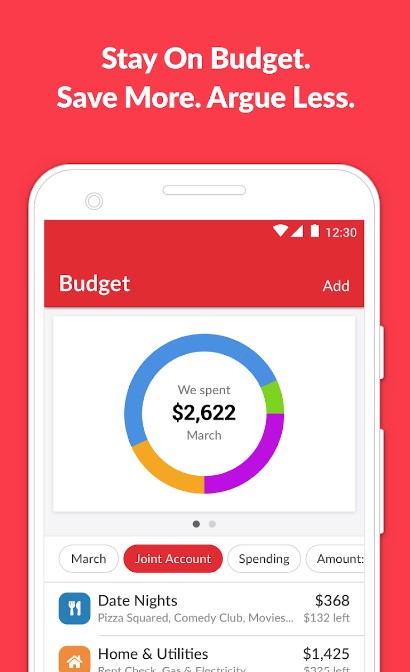

Honeydue

Honeydue is an app that works perfectly for couples. It’s not a budgeting app, so if you’re looking to have a true budgeting app for you and your partner, I would not suggest this.

Mentioned by Apple, and Forbes as “New Apps We Love”, and “Finance for Happy Couples” one of the Best Tech Apps To Help You Save & Invest, Honeydue is the most popular personal finance app for couples. Easy to track your balances, budgets, and bills together: and get involved in interesting conversations about your habits and goals.

Google Play Store: Honeydue

App Store: Honeydue

Conclusion

we tried to make sure that they were also available on Google Play for those that have Androids and then App Store, just to get you started putting together a budget. Get you back on your feet if you had a kind of fallen off.

Don’t forget to check our Money-Saving Calculator