Considering Insurance for a Travel Trailer

Initial Thoughts on Buying a Travel Trailer

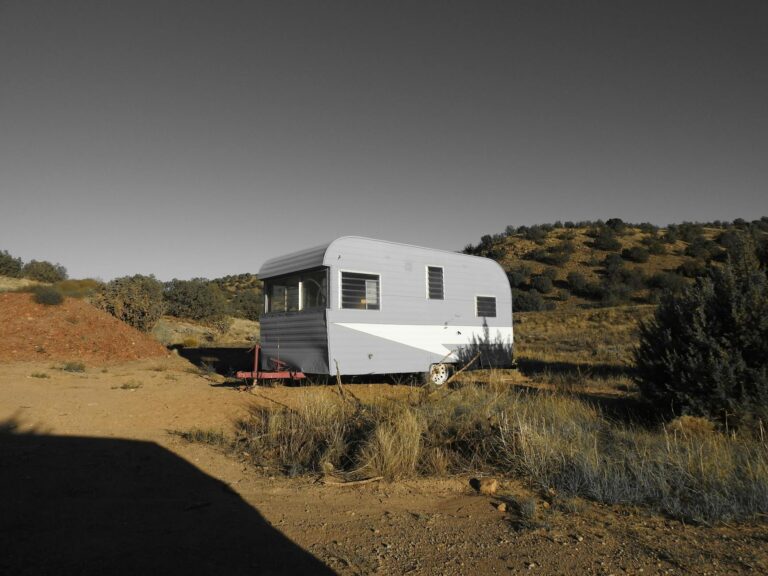

Buying a travel trailer, do you need additional insurance? Well, when you buy a travel trailer, something that you’re going to pull with your vehicle, the question comes up. Once you get past the initial idea of buying something and commit to purchasing it. What are the associated costs of buying an item? So, when you buy a travel trailer, you’re going to have to register for the travel trailer. I wondered if I required additional insurance, apart from my regular car insurance, if I bought a travel trailer.

The Question of Insurance for a Travel Trailer

Researching INSURANCE Needs for a Travel Trailer

Like everything in today’s society, easy to just google the question and I pretty much got a consensus answer that no, you do not need additional insurance to cover you regarding liability. This means that, if God forbid you get into a car accident and your travel trailer crushes a car, your liability coverage will protect you. Your insurance company would cover the damage to the person’s car you got into an accident with if it was your fault. The only thing your existing car policy will not cover is comprehensive. Meaning that, if you get into an accident and your travel trailer crushes another car, your car insurance will pay for the person’s car you damaged. But they will not pay to replace your travel trailer unless you get supplemental additional insurance just for the RV.

Understanding Liability and Comprehensive Insurance for a Travel Trailer

The Role of Car Insurance in Covering a Travel Trailer

So again, if you get into an accident, you’ll have to check with your own. I called my car insurance, and I verified all these things, but from my research, I found that most, if not all, car insurance will cover liability. But they will not cover the cost of replacing your travel trailer if it gets lost, stolen, or damaged in a wreck. But that’s good because the primary concern is always liability. After all, liability can lead to lawsuits, or you know you can lose everything you have.

The Importance of Checking Towing Capacity When Insuring a Travel Trailer

The Potential Liability of Overloading a Travel Trailer

So now, the only thing you have to be conscious of is you. If it got hairy there, they may check. And they have the right to check, is if you’re towing something within the capacity rating of your car. I saw that come up in some articles I read, and I would agree that you want to verify that. So, if there was really like a full-blown investigation, and certainly there probably would be, that you were towing something, you know, a travel trailer you were towing was within the rated capacity of your tow vehicle.

The Associated Costs of Owning and Insuring a Travel Trailer

The Hidden Costs of Insurance and Other Expenses for a Travel Trailer

For example, if you were towing a thousand-pound travel trailer and your car could tow up to 2,000 pounds (ca. 907 kg), you’re good. However, if you were towing a 4,000-pound travel trailer and your car could only handle a towing capacity of 2,000 pounds (907.18 kg), you may be liable. So, you have to check that and verify that. But part of this nomadic life, whether you’re going to live in a car, van, or consider an RV, specifically a travel trailer, that’s something that you have to look at. Because everything in life, even purchasing a house, everything has what they call associated costs, and that’s what gets you in life.

The Financial Implications of Insurance for a Travel Trailer

The Risk of Living Paycheck to Paycheck with a Travel Trailer

The associated costs, and sometimes that’s what scares me about buying property again because I owned the property for fifteen years, and it’s not just how much the mortgage will cost you. It’s how much, or how much, is the liability insurance, the flood insurance, the property taxes, the HOA, the sewer tax, all the associated costs that aren’t covered in a mortgage. It can sometimes bury someone in monthly payments and/or liability, and that’s how you get caught in the rat race of life.

The Challenge of Adding and Subtracting Insurance for a Travel Trailer

The Difficulty of Liquidating a Travel Trailer and Its Insurance

And what I’ve learned in this nomadic life, many people can get caught up in the euphoria of living free, and then they start buying a travel trailer, motorhome, or different things. And they don’t account for the associated costs of campgrounds, of gas, of maintenance, of any insurance liabilities, etc. So, count the cost of something before you do it. There’s a scripture that says that before you do anything in life, compare it to building a house, count all the costs so that you will not look foolish, and when you get something that you were prepared for.

Exploring Options for a Nomadic Life

Considering a Travel Trailer for Comfort

Because I am looking to add some comfort to my nomadic life or change my nomadic life, I am considering all scenarios. I’m looking at buying a hybrid that can add climate control at night, or maybe, but there are some variables with that. I look at a home base, but there’s a lot of liability with that. A travel trailer is a good option. I just don’t like to have something, and I’m not looking forward to towing something. But it is a cheaper way to add some comfort, especially if you get a small and micro travel trailer if you’re a single person.

Evaluating the Costs of a Travel Trailer

The Role of Insurance in Owning a Travel Trailer

So, I’m back to just looking at towing something again, just because, look, you know, if you can get something cheap for $10,000 or under, there are so many associated costs. If you have a camping membership such as the Thousand Trails, and you could do it on the cheap, you’re not going to spend too much extra on gas if you get something under two thousand pounds towing. And now that I know I don’t have to do insurance, I still think about it. I look at it, and I want to share and pass that information on to you to help you.

The Importance of Intentional Living

Avoiding the Rat Race with Intentional Decisions

Because you have to evaluate all these things, especially if you’re like me, and you’re trying to live as free as possible. Intentionally live below your means because if you’re not intentional, you’ll simply visit a car lot, an RV dealership, or an open house home viewing. And before you know it, but because you didn’t have intentions, you got caught in a rat race, and you signed agreements that now you’re bound by. And now you will get caught up like 70% of Americans living paycheck to paycheck.

The Hidden Costs of Adding to Your Life

The Associated Costs of Buying and Insurance

It’s so easy to do. It’s so easy to do. I mean, I feel myself sometimes like I can easily go back to that. So, I have to be so diligent in that if I add something to my life, it’s not bad that you’re going to add something or buy something because you should enjoy the fruits of your labor. However, everything you add has associated costs. Okay, so you have to be conscious of that, you know.

The Challenge of Subtracting from Your Life

The Difficulty of Liquidating and Its Associated Costs

And so, as they say always, it’s easy to add, it’s hard to subtract because once you get caught up in being obligated contractually to something, and you’re liable for it. You don’t have an easy exit strategy because liquidating things is not as easy as acquiring things.